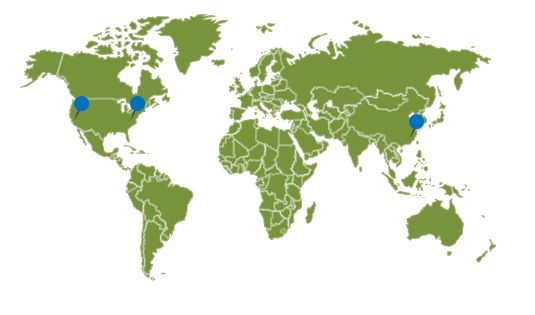

ZhongMei Capital invests in transformative biopharma assets with US-China market synergies

We actively seek out pre-clinical stage biopharmaceutical companies with cross-border collaboration opportunities. We identify underserved disease states and look for assets overseas to fill the unmet need. We are long-term investors, and partner with like-minded entrepreneurs to unlock hidden value and create outsized returns. At our core, we serve as a bridge linking capital, technology, scientists, and cultures.

We believe that innovative science transcends geopolitics, and that developing life-saving medicines is sacred common ground amongst healthcare practitioners. Forging global partnerships and fostering mutual understanding allows us to do well by doing good. We focus on bridging cultural and linguistic divides to both foster a healthier world and generate outsized returns for our investors.

Our core business model is centered around finding and investing in undervalued assets in China that have the potential to be developed in the United States. We partner closely with US based investors, contract research organizations, and clinical pharmaceutical companies to give our portfolio companies the best chance to develop their assets in the United States.

We also invest in specific US based start-ups that are developing assets that are of specific interest to large domestic Chinese pharmaceutical companies. We work with our US portfolio companies to find Chinese partners and expand into the Chinese market.

Anthony is responsible for HuntBest’s global strategy and partnerships. He has a wealth of experience overseeing cross-border biopharma deals. He started his career as a strategy consultant at Monitor Deloitte, where he was responsible for developing pipeline strategy for the world’s leading MNC’s. Prior to joining HuntBest, Anthony also held leadership positions in business development and strategy at Gilead Sciences and Jazz Pharmaceuticals. His experience working for and with many of the US’s leading biopharmaceutical companies provides valuable insight to HuntBest’s current and future portfolio companies.

Anthony holds an MBA from Columbia Business School, and a BS in chemistry from the University of California at Davis.

Ethan is responsible for HuntBest’s investments in novel technologies and modalities, with a particular lean towards SiRNA platforms. He has a long and successful track record as an executive in the healthcare CMC space, having served as the Vice President and Associate General Manager of Asymchem, a leading CDMO in China prior to joining HuntBest. While at Asymchem, he oversaw the clinical development and manufacturing of many of China’s leading pharmaceutical compounds. He currently also serves as a Council Member of the TongXieYi RNA Therapeutics Committee, where he is involved in the bleeding edge of new RNA therapeutics research.

Ethan holds a PhD in chemistry from the Chinese Academy of Sciences and has been published in journals such as JACS, ACIE, and ORPD during his time as an academic researchers.

Kevin founded HuntBest with the intention of providing both funding and expertise to undercapitalized and undiscovered entrepreneurs in China. His global vision for HuntBest has attracted a myriad of top-tier LP’s, corporate partnerships, and high-growth portfolio companies. Prior to founding HuntBest, Kevin held a leadership position at PrimaVera Capital, where he was responsible for deploying overseas investments and managing global partnerships. Prior to HuntBest, Kevin was an investment banker at Goldman Sachs, where he covered M&A transactions in the renewables space.

Kevin holds a PhD in chemistry from the Chinese Academy of Sciences, a post-doctoral from the University of Wisconsin, and an MBA from the Rotman School of Management.

Wenjun is responsible for managing the HuntBest’s domestic healthcare portfolio. He has a deep expertise in clinical operations and start-up investing, and serves as a board advisor to many of the companies he has invested in. Prior to HuntBest, Wenjun was an investment manager at Teda Venture Capital, where he oversaw venture investments into promising Chinese healthcare companies. Prior to Teda Venture Capital, Wenjun was a R&D project director as Asymchem, as leading Chinese CDMO, where he was responsible for ensuring timely and efficient clinical operations for his biopharmaceutical clients.

Wenjun holdTsinghuas a PhD in chemistry from Nankai University, and a post-doctoral at Georgia State University and University.